MARKET OVERVIEW FOR ACTUARIES

The last year was a very strong market for actuaries and analytics professionals, with insurance companies and consulting firms expanding and seeking top talent to fill new roles throughout 2022. This expansion reflects the Department of Labor projection of a 20% or more increase in growth for actuaries this decade, with about 2400 openings expected each year. The drastic increase in the availability of remote roles in 2022 allowed for more candidates to easily move to new roles, leaving vacancies that needed to be filled. After some hesitation during the pandemic, any reluctance for candidates to change jobs disappeared in 2022, and in 2023 we continue to see candidates seeking new opportunities with higher compensation, remote options, and a better work/life balance. For 2023 we expect this growth to be sustained, but with less opportunity for fully remote positions. The low unemployment rate for actuaries will continue and will add to the challenges of hiring top talent in 2023.

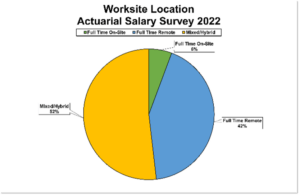

Remote work continues to drive candidates, in particular candidates who are being required to return to the office on a full time or hybrid schedule. In contrast, employers are less inclined to offer fully remote opportunities, opting instead for in office or hybrid schedules. The graph below shows the 2022 breakdown of office/hybrid/remote roles. In contrast, in 2000 just 5% of roles were remote, with 95% in office. In 2021, 80% were remote, 16% were hybrid and 7% were in office.

Actuarial Salary Survey 2022 Worksite Locations

Life Insurance

Life insurance reinvention will continue in 2023 as the industry works to ensure ongoing relevancy. Pushed by current geopolitical and financial challenges, life insurers will remain focused on system modernization. Insurers will need to be more digital and consumer-centric to attract a younger demographic. Other trends we see for 2023 include:

- An increase in IFRS 17 / LDTI implementation work will continue to drive more activity.

- Technology – modernizing systems will be a focus.

- Changing customer needs and expectations of more personalized products. RILAs are the fastest-growing product in the annuity space.

- New products designed to reach new markets/underserved markets.

- Speed to market underwriting time continues to accelerate.

- Higher interest rates and inflation impacting M&A activity.

- Stock market volatility, inflation, and concerns of recession will affect demand.

- An increase in analytic focused work and a growing demand for actuaries to expand into the analytics space.

- Private capital–backed fund managers, both big and small, are entering the life insurance market through partnerships, acquisition, and reinsurance. Disruption in the annuity space as some traditional insurers are willing to shed their annuities business to free up capital.

Health Insurance

The unwinding of the public health emergency will have a significant impact when it expires in April 2023. The continuous coverage requirement authorized by the Families First Coronavirus Response Act (FFCRA) will be the largest health coverage transition event since the first open enrollment period of the Affordable Care Act. It is estimated that up to 18 million people could lose coverage within 14 months of the end of the program and a large share of those individuals will be transitioning into their employer’s plan. Many of these individuals will be lower wage workers. Other trends in Health insurance will include:

- Focus on wellness of employees, transforming from a treatment-based care system to one that is focused on prevention and well-being.

- Behavioral health has increasingly become a focus area with insurers.

- The cost of prescriptions drugs remains an area of concern and legislative decisions regarding prescription costs will affect insurers.

- The industry is shifting its focus toward value-based care. We are seeing both start-ups and established insurance companies seeking actuaries with coding and even AI/machine learning experience. Medical Economics is a growth area with provider/hospital systems growing their in-house actuarial staff to provide more customer focus and data driven analytics to improve outcomes, treatments, and productivity.

- There is still uncertainty surrounding the long-term effects of Covid and its impact on health insurance.

- While startups continue to disrupt the healthcare space, the biggest threat might come from the non-insurance sector such as e-commerce and other retailers.

- While the days of mega-mergers are behind us, merger activity will remain active and focus its strategies on diversification and vertical integration.

P&C Insurance

The P&C industry experienced huge net underwriting losses in 2022, due partially to global insured natural catastrophe losses. Economic and social inflation, geopolitical uncertainties and weather-related cat losses will lead to significant rate increases across many lines of business. Average premium renewal rates have increased for all commercial lines except for WC. Other trends for 2023 include:

- Hurricane Ian caused an estimated $65 billion dollars in losses, and weather losses will continue to affect the market. Weather related water damage claims from winter storms will continue to increase.

- Homeowners insurance continues to see significant increases, especially in Florida. According to the Insurance Information Institute, premiums in Florida are expected to increase an average of about 40% this year, even though lawmakers in Tallahassee approved sweeping reforms.

- Climate Change, Cyber Risk and Telematics will continue to grow in conjunction with Data Science and Predictive Modeling. Hurricanes, earthquakes, and wildfires continue to be major risks and Cyber insurance will continue to be affected by ransomware.

- Auto insurance costs are being driven up by inflation and increased costs for repairs and replacement. Continued R&D into automation in vehicles will affect insurance, although the real growth of that market may be years away.

- The war in Ukraine, despite war-exclusion clauses for insurers, will still influence premiums in some specific industries, such as aviation, marine, and energy, with additional impact due to supply-chain and business interruptions.

P&C Reinsurance

2022 was another year of major hurricanes, resulting in significant losses for the reinsurance and the ILS space. The aggregation of losses resulted in rate increases. As a diversification strategy, Bermudian reinsurers adopted hybrid models deploying both reinsurance and insurance lines. Global reinsurers expanded into direct lines of insurance program business through MGAs, not only to diversify its book, but take advantage of strong rates in the US.

The US property Cat reinsurance ROL Index increased by 30% at the January 2023 renewals, an all-time high according to the latest data.

Insurtech

Current data shows that global insurtech investments declined by 57.0% to $1.01 billion in the fourth quarter of 2022, when compared with the previous quarter. Insurtech funding is at its lowest quarterly point since Q1 2020. In the property and casualty sector Q4 funding fell by 64.4%, while total Q4 investments in life and health fell by 33.7%. Total funding for 2022 was down by 49.5% from 2021, to $7.98 billion.

2023 RECRUITING OUTLOOK

The prevalence of remote opportunities and opportunities for increased compensation may have driven the “Great Resignation” of 2022, but a lack of flexibility for remote or hybrid work will continue to drive employee resignations in 2023. The significant increases to compensation have leveled off, but candidates are now focused on work/life balance, including remote or flexible work options. Retention of staff will still be a strong focus for employers, especially those companies requiring employees to be in the office. Counteroffers will be made, and flexibility for hybrid or remote work will be an important negotiating point.

Studies over the past year, and our internal data, have shown that more employers prefer on-site or hybrid (2–3 days on-site) arrangements where possible. A recent Gallup study showed that 89% of workers are very likely to start a job search if their current employer will not offer a flexible work environment. This is in direct opposition to the current trend of companies requiring new and current employees to return to the office and this information translates into a distinct advantage for companies allowing remote or flexible work options to attract and retain top talent. Office occupancy across 10 major US cities is now at more than 50% of pre-pandemic levels for the first time since early 2020, when many offices sent workers home because of Covid. According to data from office swiping systems, these offices are still mainly on hybrid work schedules, with Friday having the lowest number of in office employees and Tuesday having the highest.

According to a 2022 LinkedIn survey, the generational breakdown of employees leaving or considering leaving a job because of a lack of a flexible work policy are Gen Z (72%), Millennials (69%), Gen X (53%), Baby Boomers (59%). Clearly, flexible schedules are important to all generations, but by the year 2030, the number of Gen Z employees is expected to triple, with employees born from 1995 – 2012 making up about 30% of the workforce. Their preferences will shape the future of the workplace over the next 20 years. As a generation shaped by the pandemic, they also appreciate in-person office interaction, but want the freedom to have flexibility for hybrid work options. Recruiting and retaining these candidates requires a more flexible attitude toward hybrid and remote positions.

Another important factor in hiring is the company’s commitment to Corporate Social Responsibility (CSR). Most candidates make a point of researching potential employers, and a company’s reputation, branding and social responsibility are important to job seekers. Commitments to diversity and inclusion, ethics and responsible environmental practices are all important factors that candidates consider before applying or interviewing for a role. Higher salaries do not offset a lack of social responsibility for candidates.

2023 will see more pay transparency laws being implemented. These laws are in place to help close wage gaps across gender, racial and LGBTQ identities, and approximately 25% of the workforce in the US will be covered by pay transparency laws by the end of 2023. For states without pay transparency laws, positions for remote candidates based in states with these laws in place may also be covered.

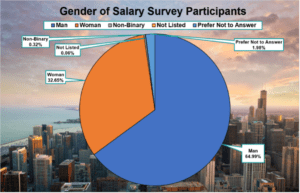

Gender of Salary Survey Participants

IN SUMMARY

2023 will continue to see challenges for companies seeking to hire actuaries and analytics professionals. The hiring challenges we expect to see include:

- Continued low unemployment rate for actuaries and analytics professionals in the insurance industry.

- Candidates’ requirements for flexible schedules.

- Company policies requiring current and future employees to work in the office.

- Longer time to hire for positions that do not allow for flexible schedules.

- Students moving from actuarial into roles in similar fields such as data science.

The 2023 recruiting landscape will see a focus on flexible schedules, diversity & inclusion, pay transparency and Corporate Social Responsibility.

DW Simpson Global Actuarial and Analytic Recruitment has been serving the actuarial industry for over 30 years as the largest recruiting firm specializing in the placement of actuaries, data scientists, predictive modelers, and CAT modelers. The average tenure of our lead recruiters at DW Simpson is 14 years, which translates into strong relationships with candidates and clients, and is unsurpassed in our industry. The actuarial recruitment and placement process is our specialty, and we are the experts in our industry.