2023 ACTUARIAL RECRUITING CONCLUSIONS

The second and third quarter of 2023 showed challenges in the actuarial recruiting market, driven by several factors. These included concerns about the economy and a possible recession, in addition to a lack of flexibility in hiring remote worksite candidates. In 2022, the prevalence of remote opportunities and increased compensation was the driving factor of the “Great Resignation”. In 2023 the lack of flexibility for remote and hybrid work was the driving factor for many actuaries, with candidates now focused on work life balance, mainly through remote work. The significant increases to compensation in 2022 also leveled off, resulting in less incentive for candidates to relocate for a new opportunity. Remote positions maintained strong candidate interest with the most applicants by far.

Retention of staff remained a strong focus for employers, especially those companies requiring employees to be in the office. Companies made more counteroffers, in many cases offering flexibility for employees to remain remote in order to retain those individuals. This was balanced by requiring new hires to be onsite or hybrid.

2024 Market Trends for Actuaries

There are many factors that will affect the 2024 market for actuaries. Although the likelihood of a recession is much lower than it was a year ago, we are still feeling the effects of a tightened economy. Indications are that employment growth will remain positive in 2024 but at a slower pace than over the last 2 years, with the Bureau of Labor Statistics reporting that job openings fell from a high of 12 million in March 2022, to 8.8 million in November 2023. Although job postings on sites like Indeed and LinkedIn remain strong overall, they are significantly lower than the high levels in 2022. This decline in job openings is expected to continue through the first half of 2024.

The US labor market outlook for 2024 is expected to normalize following the pandemic volatility, with a recession less likely and inflation trending lower. In 2023 salaries continued to increase, but wage growth slowed from the dramatic pace of 2022, which saw historically high growth. In 2024, we expect to see wage growth more in line with pre-pandemic levels.

The Bureau of Labor statistics projects that employment of actuaries will grow 23% from 2022 to 2032, which is considerably faster than average for all occupations. Once again, actuaries consistently rank as one of the top business jobs, top STEM jobs, top paying jobs, and of course one of the top “Best Jobs Overall” per US World and News Report. Over 2300 openings for actuaries are projected each year over the next decade. In addition to growth positions, many of these openings will result from the need to replace workers who will be exiting the labor force to retire. Nearly 50% of the insurance sector planning to hire say they need to increase staff to meet growing business demands, or to enter new insurance markets. A small percentage of companies planning layoffs attributed them to automation or overstaffing.

As technology advances, the role of actuaries is expected to undergo transformation. Automation and artificial intelligence are likely to streamline routine tasks allowing actuaries to focus more on strategic decision making.

Remote/Hybrid/Return to Office

Once again, demand for actuaries remains high and employers face a competitive market for top talent. To hire the best candidates, employers will need to be sensitive to the preference for remote work, which remains high. In 2023, employers continued to push back to office initiatives and candidates continued to seek remote roles. Work/life balance remains the top priority, but mortgage interest rates and a challenging housing market are a significant factor. In December 2023, 8.9% of US job postings on LinkedIn were listed as remote, while 45.9% of job applications on LinkedIn were for remote roles, showing a significant preference by candidates for remote work. This disconnect continues to challenge the market.

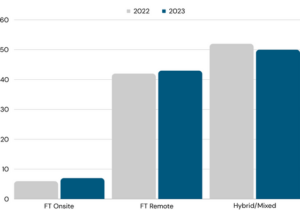

A recurring theme from 2023 is the candidate’s strong preference to work from home. There are multiple considerations for the continuation of work from home opportunities, including work/life balance, daily commute time and expense, childcare flexibility, and reduction of pollution and energy consumption. As recruiters we are seeing that the majority of candidates want a remote or local hybrid opportunity, with little appetite for relocation. We can say with confidence that remote and hybrid work options are here to stay. Gathering information from our salary surveys, we saw a minimal change in the percentages of candidates working from home/hybrid and in the office from 2022 to 2023 (see graph below).

Most employers now are asking for a hybrid schedule from their employees of two to three days a week in the office. This can work well with employees who live in the local area, but if you are seeking strong actuarial talent to fill open positions, your candidate pool will be much more limited. To capture the best candidates, a remote option may be necessary. There is a school of thought that having staff in the office increases chance encounters for brainstorming and builds a more cohesive team. The other point of view is that return to office policies may result in more burnout and less retention of employees. From a financial standpoint, many employees are reticent to return to the office and incur increased commuting and childcare costs, with working parents in particular benefiting from having work from home options.

Industry Trends for 2024

Life/Annuity

- Following nominal premium growth in 2023, Life insurance premiums dipped further in the first half of 2023, but showed improvements in the second half. US retail life premiums are expected to exceed 5% in the next couple of years as stabilization takes place in both the regulatory environment and the economy.

- Sales of annuity products hit record highs in 2023, beating the previous years’ record. This trend is expected to continue.

- There is a continued trend of growth and demand for more individualized, customized, and customer focused products in all areas.

- Life and annuity carriers continue to focus on transformation and modernization, which should make them more prepared for continued growth in the face of changing types of demand.

- The falling interest rates expected in 2024 will benefit IUL and RILA sales and lower the demand for fixed rate deferred and fixed indexed annuities. Traditional variable annuities should benefit from a growing equity market.

- There is a continued trend of growth and demand for more individualized, customized, and customer focused products in all areas.

- 2023 saw a continued increase in global Pension Risk Transfer (PRT) market activity.

- Life insurance companies should benefit from the higher interest rates from 2023 which would boost investment income.

Health

- Health insurance costs will continue to climb at a significant rate in the new year. One contributing factor is a result of the increasing popularity of the weight-loss and diabetic drugs.

- The healthcare industry is on the brink of a significant transformation. A recent analysis reveals an expected surge in government segments within payer profit pools. By 2027, these segments are predicted to be 65% larger than commercial segments. This is a monumental shift, driven by increased Medicare Advantage penetration and growth in the dual eligibility segment.

- As long-term care costs continue to skyrocket, more attention is being focused on employee benefits. Supplemental health products (accident, critical illness, cancer, and hospital indemnity) are expected to continue to increase, as they did in 2023.

- Wearable detections and biomonitoring should continue to help with catching existing conditions and health issues early. Improving predictive modeling and health care will guide rate setting and claims.

- 2023 was a challenging year for the Medicare business having to navigate increasing medical costs for insurers and facing slower growth. Many of the biggest players suffered steep losses at year’s end.

Property & Casualty

- Personal lines carriers saw double-digit rate hikes for some, leading to record profits in the fourth quarter. We can expect a hard market to persist with Personal lines recovery and the continued hardening of the reinsurance space. Climate change, continued supply chain issues, global conflicts, economic downturns, cyberattacks are still significant factors.

- Insurers will continue to leave vulnerable markets in states like California and Florida which have higher fire and flood risks.

- Costs related to vehicle theft and inattentive driving are increasing while premiums continue to rise.

- New advancements in technology are continuing to be utilized, including earlier detection, and targeting of fire prone areas, which will continue to improve and help lower costs.

- Inflation, construction costs, supply chain disruptions, soaring litigation, and advancements in vehicle technology contributed to increased claims costs in 2023. As homeowners and small business owners struggle, especially in Florida and California, it provided an opportunity for the E&S market to capitalize.

- Cyber-attacks keep rising year after year and the cyber insurance market is expected to continue to grow significantly. The insurance sector is reacting to the need to prioritize cybersecurity as technology advances, to protect sensitive information and ensure a secure environment for customers.

Catastrophe

Insured global losses remained in between the ten and five-year average with $95bn. Without any major catastrophe losses, it was the secondary perils that dominated 2023, including the record $50bn – $60bn in losses due to convective storms. It appears that these trends have become the “new normal”.

P/C Reinsurance

In 2023, the global reinsurance industry’s financial strength remained healthy with a trend of underlying profitability. US demand for catastrophe reinsurance alone is expected to grow as much as 15% by 2024, putting further upward pressure on prices. Demand for catastrophe bonds continued exceed supply, as alternative capital markets seek to supplement traditional reinsurance.

Insurtech

Although funding has not yet returned to pre-pandemic levels, insurtech is expected to experience strong growth in 2024, driven by the integration of AI to improve efficiency, streamline processes such as underwriting and claims management, and reduce costs for insurers.

- Consumer demand for personalized insurance solutions will continue with innovative technology, such as AI, allowing Insurtech’s to capitalize on this opportunity by offering products that are tailored to specific customers.

- The health segment remains one of the strongest insurtech markets and is driven by the appetite for digital platforms that connect carriers with providers, customers, and brokers, and the increasing adoption of technology-driven solutions aimed at improving both the efficiency and accessibility of healthcare insurance services.

- The rising cost of healthcare, the growing demand for personalized insurance plans, and the integration of AI and machine learning for risk assessment have significantly contributed to the health segment’s leading position in the Insurtech landscape.

- Traditional insurance companies are recognizing the value of partnering with insurtech startups. Strategic partnerships, joint ventures, and investments in insurtech firms will continue, which will provide insurtech startups with access to capital.

- The increased adoption of devices such as fitness trackers, car telematics, smartphones, and medical sensors will contribute new data, which will lead to a more comprehensive understanding of customers and their risk, and more accurate pricing options.

- Embedded insurance will continue to grow by integrating more insurance options into a customer’s buying experience at the point of sale.

The Insurtech market will continue experiencing significant growth, with a projected value of USD 336.5 billion by 2032, and a projected Compound Annual Growth Rate (CAGR) of 41.0% from 2023 to 2032. North America continues to be the top market with a 33.6% share of the global market revenue.

2024 Recruiting Outlook

Candidates

As we saw in 2023 and continue to see in 2024, actuaries remain in high demand. With exceptionally low unemployment and high job satisfaction, a career as an actuary continues to be a great decision. Although hiring slowed in the second half of 2023, and it is expected to continue at those levels for the first half of 2024, projections are that hiring will pick up significantly in the second half of 2024.

The most highly desired candidates will continue to have top technology skills, including hands-on experience with programs such as R, Python, SAS, and SQL. Demonstrating the ability to leverage and adapt to emerging technologies, including AI, will continue to be an asset to candidates. As the insurance industry continues to integrate AI technology, employment opportunities will change, and some will be eliminated. Ambitious candidates will concentrate on developing strong communication skills, effective management strategies, creativity, business acumen and the ability to translate complex concepts for decision makers, as part of the strategic team. An emphasis on continuing education to stay current with technological advancements will also be beneficial.

Candidates who are open to relocation will continue to have more opportunities for advancement and will face less competition for the best roles. As always, exam progress and a commitment to achieving associateship and fellowship is a priority.

Clients

The actuarial market remains competitive, with an exceptionally low unemployment rate. This, coupled with the unprecedented number of candidates changing jobs during the pandemic, has made 2023/2024 a challenging market for hiring. In addition, back to office initiatives have motivated candidates to look for remote positions if their current employer will not allow them to continue working remotely. When those employees leave, replacing them in hybrid or in office positions is another challenge. Most candidates who have worked effectively in a remote role do not see the value of being onsite, and the current housing market and high interest rates have also translated into fewer candidates interested in relocation for economic reasons. Employers who are open to remote hires or candidates coming to the office quarterly will have a much larger pool of qualified candidates.

To hire the best candidates, we find that work life balance is consistently a motivation for candidates looking for new roles. This is especially true for Millennials and Gen X, who now comprise a majority of the workforce. The newest addition, Gen Z,embraces remote technologies, having grown up with communication through video, email, and text. These generations are also motivated by community, a learning environment, transparency and having a voice in decision making. In contrast, the Baby Boomer generation was more motivated by teamwork, competition, and professional advancement, and they are much more likely to prefer an in-office role. As of September 2023, Millennials make up the majority of the full-time workforce with 49.5 million workers, followed by Gen X at 42.8 million, Baby Boomers at 17.3 million and Gen Z at 17.1 million. Gen Z is expected to overtake baby boomers in the workforce by next year, per an analysis of census data from Glassdoor.

Creating an inclusive and diverse work environment is also essential for retention of employees from all generations. This also remains a motivating factor and companies that have transparent policies and practices that support a diverse workforce will attract candidates. As the workplace continues to evolve, leaders must remain committed to continuous learning and adaptability to attract and retain top talent.

DW Simpson has grown to become the largest actuarial recruitment firm because of our consistent results. We are constantly growing and evolving as recruiters and industry knowledge leaders, with an eye towards becoming more effective, better educated, and continuing to drive success for our clients and candidates. Because DW Simpson is highly specialized, we have the specific expertise required to provide our clients and candidates with the resources, advice and support they need in the actuarial field and other related analytics professions in the insurance industry. The actuarial recruitment and placement process is our specialty, and we do it better, faster, and more thoroughly than any of our competitors.